- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Investor Centre

Investor Resources

Financial Calendar

Investor Factsheet

This comprehensive Investor Factsheet provides key information on MCB Group.

MCB Focus

A periodic publication prepared by MCB Group, providing economic insights on the global and local landscape.

Frequently Asked Questions

1. Annual Meeting

1.1 When is MCB Group’s Annual Meeting?

The Annual Meeting of shareholders of MCB Group Ltd is usually held around November/December and as per legal requirement, not later than six months following end of the financial year. For financial year ended 30 June 2026, the meeting will be held in November 2026.

1.2 What should I do if I’m unable to attend the Annual Meeting?

Votes may still cast on all the resolutions, by completing and returning the proxy form to the MCB Group’s Registrar & Transfer Agent by the deadline therein.

1.3 Can I vote electronically for the Annual Meeting?

No. This facility is currently not available.

1.4 Is the Annual Meeting webcast?

No. The presentation made by the Group CEO, which provides an analysis of the Group’s performance over the past financial year, is uploaded thereafter in the ‘Events & Presentations’ section of the MCB Group’s online Investor Centre.

2. Corporate Information

2.1 What are the business activities of MCB Group?

With its 187-year history, MCB Group has evolved into a reputable and prominent regional banking and financial services provider, offering a comprehensive range of tailored and innovative solutions through its local and foreign subsidiaries and associates. Established since 1838, MCB Ltd is the former holding company of the Group. It became a subsidiary of MCB Group Limited in 2014 after a corporate restructuring exercise that gave rise to a new group structure (refer to section 1.5). MCB Ltd has cemented its position as the leading bank in Mauritius, in the process playing a key role in promoting the country’s socio-economic development. The Group has widened and deepened its international business and continues to deploy its underlying growth agenda across Africa by focusing on targeted market segments where it has built expertise over time. Leveraging a wide network of correspondent banks, MCB Ltd is actively involved in cross-border deals and transactions mainly in sub-Saharan Africa. The Group as also diversified its activities into the non-banking field, offering a comprehensive range of investor-related services namely stockbroking, corporate finance advisory, investment management, registrar & transfer agent and private equity financing as well as leasing, factoring and micro-finance services.

2.2 In which countries is MCB Group present?

MCB Group has a domestic presence in Mauritius and in 10 countries abroad, namely through dedicated subsidiaries in Madagascar, Seychelles and Maldives, and its overseas associate Banque Française Commerciale Océan Indien (BFCOI - operating in Réunion Island, Mayotte and France) as well as via the operation of the representative/Advisory offices of MCB Ltd in South Africa, France, Kenya, United Arab Emirates and Nigeria.

2.3 What are the contact details of MCB Group Ltd?

Sir William Newton Street

Port Louis – Republic of Mauritius

Tel: (230) 202 5000 – Fax: (230) 208 0248

Email: [email protected]

Website: mcbgroup.com

2.4 Who is MCB Group’s Registrar & Transfer Agent?

MCB Registry & Securities Ltd

Raymond Lamusse Building

Sir William Newton Street

Port Louis – Republic of Mauritius

Tel: (230) 202 5640

Email: [email protected]

2.5 How is the MCB Group organised?

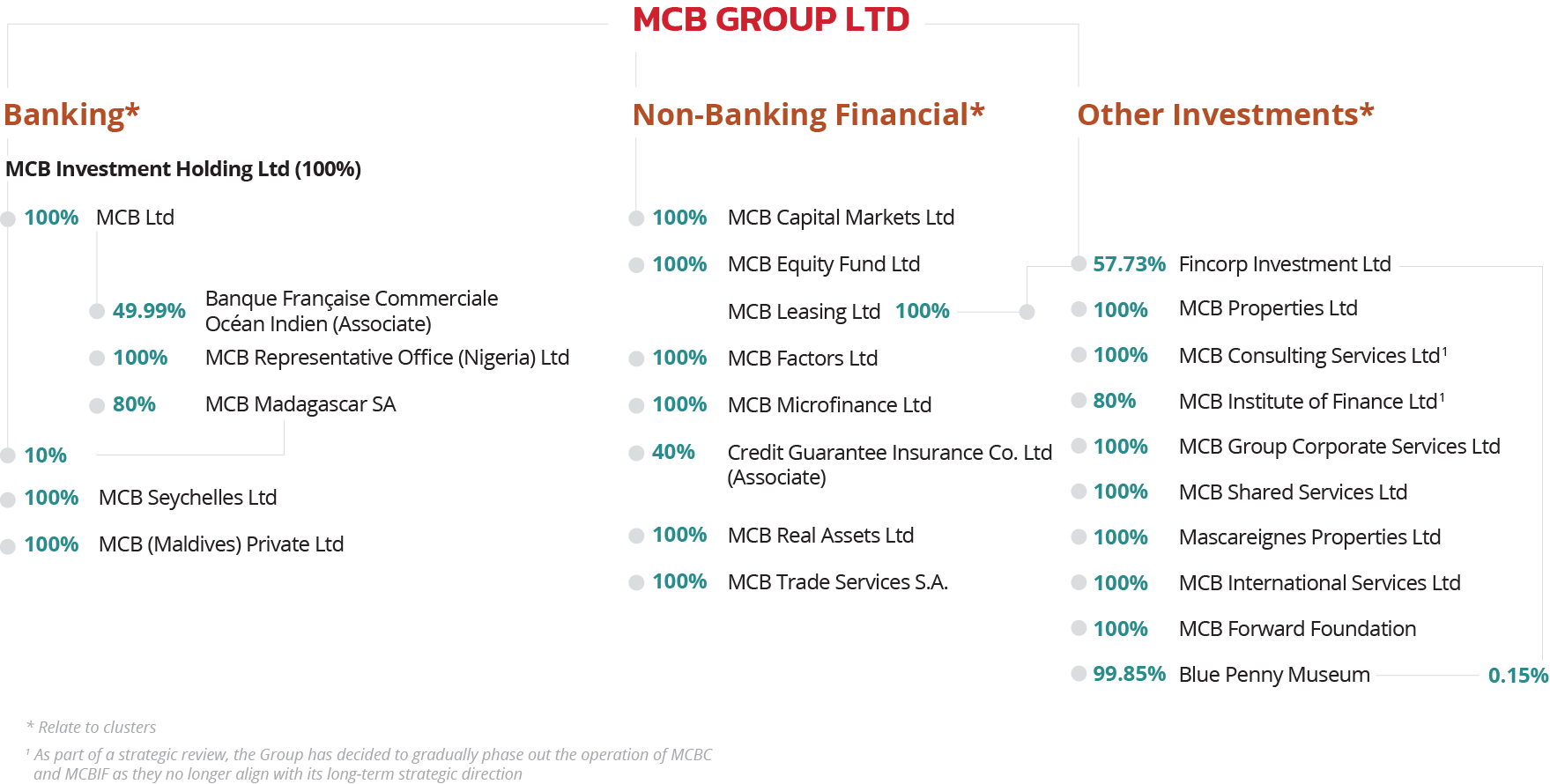

MCB Group Ltd acts as the ultimate holding company of the Group and the subsidiaries and associates thereof operate under three distinct clusters namely Banking, Non-Banking Financial and Other Investments. MCB Investment Holding Ltd, a wholly-owned subsidiary of MCB Group Ltd, is the holding company of all the banking investments of the Group, namely MCB Ltd and overseas banking subsidiaries and associates.

2.6 Which is the largest entity within the Group?

MCB Ltd, which accounted for a share of some 91% of the Group’s assets and 90% of the Group’s profits respectively as at 30 June 2025.

2.7 How many employees does MCB Group have?

There were around 4,900 employees as at 30 June 2025.

2.8 How can I learn more about MCB Group’s Corporate Governance?

MCB Group’s principles and commitments in terms of corporate governance are described in the ‘Corporate Governance’ section of the Annual Report of MCB Group Ltd, which is also available on MCB Group’s website.

2.9 Where can I view directors’ profiles?

Please refer to the ‘Board’ section on MCB Group’s website.

2.10 What are MCB Group’s credit ratings?

The credit ratings relate to MCB Ltd and are currently as follows:

| Agency | Outlook | Long Term | Short Term |

|---|---|---|---|

| Moody's Investors Service | Negative | Baa3 | P-3 |

| Care Ratings (Africa) Private Limited | Stable | AAA* | |

* Pertains to the servicing of financial obligations in Mauritius

3. Dividends

3.1 Does MCB Group pay dividends?

MCB Group Ltd seeks to distribute around one third of its profits in the form of dividends.

3.2 Where can I find out about historic dividend payments?

Dividend history can be viewed in the ‘Shareholder Information’ section of MCB Group’s online Investor Centre.

3.3 Can I have my dividends paid into my bank account?

Yes. Share certificate holders shall contact the MCB Group’s Registrar & Transfer Agent where relevant documents will need to be filled in. On the other hand, CDS account holders shall contact their broker.

3.4 Who do I contact if I haven’t received my dividend entitlement advice or my dividend payment?

Any dividend enquiries shall be directed to the MCB Group’s Registrar & Transfer Agent.

(email: [email protected])

3.5 When was the most recent dividend paid?

An interim dividend of Rs 10.50 per Ordinary Share was declared in May 2025 and has been paid in July 2025. A final dividend of Rs 15.00 was declared in September 2025 and was paid in December 2025.

3.6 I am a foreigner. Can I invest in MCB Group?

Yes. As referred to in Section 5.4, all transactions need to be made via licensed brokers.

3.7 What is my taxation position as a foreign investor regarding dividends?

There is no withholding tax on dividends and no tax on capital gains. Foreign investors can freely repatriate revenue on sale of shares as there is no exchange control. According to the Securities (Investment by foreign investors) Rules 2013, foreign investors do not need approval to trade shares, except for the holding of more than 15% in a Mauritian sugar company.

3.8 What is the meaning of ‘cum dividend’, ‘ex-dividend’?

'Cum-dividend' means the shares are entitled to dividends. Buyers who purchase shares in this state will receive the dividend when it is due.

'Ex-dividend' means the shares come without the dividend. This means the buyer is not entitled to the latest declared dividend. Instead, the seller receives the dividend even though they do not hold the shares when the dividend is paid.

3.9 Does MCB Group offer a Dividend Reinvestment Plan?

Yes. The Board of Directors of MCB Group Limited approved on 28th September 2021 a Scrip Dividend Scheme and the rules governing the Scheme. Under the Scheme, the ordinary shareholders of MCB Group will have the option of receiving their future dividends, or part thereof, by way of ordinary shares in MCB Group. More details can be found in the ‘Shareholder Information’ section on the MCB Group website on mcbgroup.com.

4. Financial

4.1 When does MCB Group financial year end?

MCB Group’s financial year covers the period starting 1 July to 30 June.

4.2 What is the MCB Group’s reporting currency?

MCB Group’s reporting currency is the Mauritian Rupee (local currency).

4.3 What is the basis of preparation of MCB Group’s financial statements?

MCB Group’s financial statements are prepared in accordance with IFRS Accounting Standards and in compliance with the requirements of the Mauritius Companies Act 2001 and Financial Reporting Act 2004.

4.5 Who is MCB Group’s independent auditor?

Deloitte have been re-appointed as auditor in November 2025, until the next Annual Meeting of shareholders.

4.5 When does MCB Group report its financial results?

In accordance to MCB Group’s financial year which ends on the 30 June, full-year results are usually announced at the end of September. In addition, MCB Group reports interim results for the first, second and third quarter, within 45 days following the end of each interim quarter.

Indicative period for earnings releases are listed hereafter:

- Mid-November: Abridged Unaudited Financial Statements for the quarter ended 30 September;

- Mid-February: Abridged Unaudited Financial Statements for the semester ended 31 December;

- Mid-May: Abridged Unaudited Financial Statements for the nine months ended 31 March;

- End-September: Abridged Audited Financial Statements for the year ended 30 June.

Financial results are available in the ‘Financials & Annual Reports’ section of the MCB Group’s online Investor Centre.

4.6 Does MCB Group organise earnings calls following earnings release?

Following each quarterly results, earnings calls are organised. Moreover, the earnings call presentations and transcripts are available on the MCB Group’s online Investor Centre in the ‘Financials & Annual Reports’ section. Besides, a document titled ‘Group Management Statement’, highlighting key features of the organisation’s financial performance for the period under review, is also available under ‘Financials & Annual Reports’ section on the MCB Group’s online Investor Centre.

4.7 Does MCB Group organise analyst meetings?

Analyst meetings are organised twice yearly, i.e. after half year and full year results, to create an avenue for analysts locally to discuss with Group executives with respect to the Group’s performance and progress on strategic initiatives.

4.8 Where can I obtain a copy of MCB Group’s latest annual report?

Annual reports are available on MCB Group’s online Investor centre under the ‘Financials & Annual Reports’ section. To obtain a printed copy, please contact the MCB Group’s Registrar & Transfer Agent.

4.9 I am a prospective investor - where can I access all relevant information about MCB Group?

MCB Group’s online Investor Centre provides comprehensive information about the Group and its activities. It includes the latest Annual Report, Financial Statements, Group Management Statement and Investor Factsheet. In addition, the ‘Email alerts’ service on the MCB Group website enables subscribers to receive email notifications regarding corporate news updates.

5. Managing Your Shares

5.1 Who do I contact if I have any enquiry relating to my shareholding regarding change of name or address?

Share certificate holders shall contact the MCB Group’s Registrar & Transfer Agent, while CDS (Central Depository & Settlement Co. Ltd) account holders shall contact their broker.

5.2 Who do I contact if I have any enquiry regarding lost share certificates or dividend cheques?

Any enquiries of this nature shall be directed to the MCB Group’s Registrar & Transfer Agent.

5.3 Where can I find information regarding MCB Group share price?

Daily share price (updated on a regular basis during the day) is available on MCB Group website. Besides, historical data since 2000 can be accessed on the MCB Group’s online Investor Centre in the ‘Shareholder Information’ section. For more information, please contact the Investor Relations Unit.

5.4 How do I buy and sell MCB Group shares?

All transactions must be made via a licensed broker, a list of which is available on the website of the Stock Exchange of Mauritius Ltd. Besides, the MCB Group offers its own brokerage service through MCB Stockbrokers Ltd. Fees and commission will be applied when buying and selling shares.

5.5 How can I access details about my shares?

Security holders shall either contact the MCB Group’s Registrar & Transfer Agent or their broker, for information regarding their shareholding.

Furthermore, CDS account holders can register on the iNet portal of the Stock Exchange of Mauritius Ltd to view their account details.

5.6 Can I check my shareholding details online?

If you have an account with MCB Stockbrokers Ltd and you are an MCB Group customer, then you can access details on MCB Group’s Internet Banking platform under the ‘My Investment’ icon.

If you have a CDS account, and provided you have given your email address, you shall receive monthly e-statements. Otherwise, you shall receive your statement twice a year or as and when transactions are effected, by post.

Moreover, the mySEM mobile application also allows you to have online access to your CDS account to monitor your account activity and account status.

5.7 How can I transfer ownership of my shares?

Shares held by share certificate can be transferred by contacting the MCB Group’s Registrar & Transfer Agent, following completion of relevant documents. CDS account holders shall contact their broker.

5.8 How can I get a Proxy Form?

The Notice of Meeting and Proxy form are sent to shareholders, 21 days prior to the Annual Meeting. In case of loss, please contact the MCB Group’s Registrar & Transfer Agent to obtain a Proxy Form.

5.9 Can I opt to receive information and corporate communications in respect of my shareholding electronically?

Yes. As part of our commitment to protect the environment, MCB Group aims to reduce the number of printed copies of corporate documents by making them available on the MCB’s online Investor Centre.

If you opt to receive electronic communications, kindly complete the application form available on the MCB Group’s online Investor Centre and send it back to the MCB Group’s Registrar & Transfer Agent.

6. Shareholding

6.1 How many shareholders does MCB Group have?

MCB Group has a broad and diversified shareholder base, with approximately 24,000 shareholders, comprising around 8% foreign shareholders as at 30 June 2025.

A breakdown of shareholders by type is provided in the following table.

| Shareholders by type as at 30 June 2025 | No of shareholders (%) | No. of shares owned (% holding) |

|---|---|---|

| Individuals | 94.8 | 46.2 |

| Insurance & Assurance Companies | 0.1 | 10.7 |

| Investment & Trust companies | 0.6 | 11.1 |

| Pension & Provident Funds | 0.3 | 14.8 |

| Other corporate bodies | 4.2 | 17.2 |

6.2 Who are the largest institutional shareholders of MCB Group?

| 5 largest shareholders as at 30 June 2025 | % holding |

|---|---|

| National Pensions Fund | 7.2 |

| State Insurance Company of Mauritius Ltd | 4.5 |

| Swan Life Ltd | 3.9 |

| Promotion and Development Limited | 2.4 |

| BNYM SA/NV A/C Eastspring Investments SICAV-FIS | 1.5 |

6.3 Does MCB Group offer shares to its employees?

Yes. The Group provides an employee share option scheme, which offers eligible employees the opportunity to acquire shares in the MCB Group Ltd. Under the scheme, employees are granted non-transferable options to buy MCB Group shares with up to a maximum of 25% of their annual performance bonus. The options, which can be exercised over a period of one year through four specific windows, carry a retention period of three years.

7. Stock Information

7.1 When did MCB Group Ltd become a publicly traded company and where is it traded?

The shares of the Group are listed on the Official Market of the Stock Exchange of Mauritius Ltd (SEM) since 3 April 2014. However, MCB Ltd was the quoted company prior to the restructuring exercise and its shares were listed on SEM since its inception in 1989.

7.2 What is the ticker symbol for MCB Group Ltd stock?

MCBG

7.3 Is MCB Group Ltd listed on other Stock Exchanges?

No. MCB Group Ltd trades only on the Official Market of the Stock Exchange of Mauritius Ltd.

7.4 What are MCB Group Ltd’s stock codes?

MCB Group Limited Security Symbol: MCBG.N0000

MCB Group Limited ISIN: MU0424N00005

MCB Group Reuters Code: MCBG.MZ

MCB Group Bloomberg Code: MCBG MP

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.